Principles to build wealth

You can find many books on the market teaching how to get rich, some books even teach people to get rich quick. I do not believe that there are ways to get rich quick. Leonardo da Vinci said that ‘He who wishes to be rich in a day will be hanged in a year’.

Getting rich takes time, from a few years to over ten years. However, it is very hard in principle. That is the reason most of us do not make it in a lifetime.

I prefer the word Wealth to rich. Wealth is our assets that can earn money when we are sleeping or on vacation or spend time with our loved ones. If we can maintain a reasonable standard of living without worrying about making a living, we are quite wealthy.

Wealthy is very helpful and essential to live happily in life, it solves many money problems and open doors to opportunities. For instance, when we are wealthy, we can have more time to think and pursue hobbies, doing interesting projects. We can afford our children good education and provide them with good and meaningful experience to develop their competences for future.

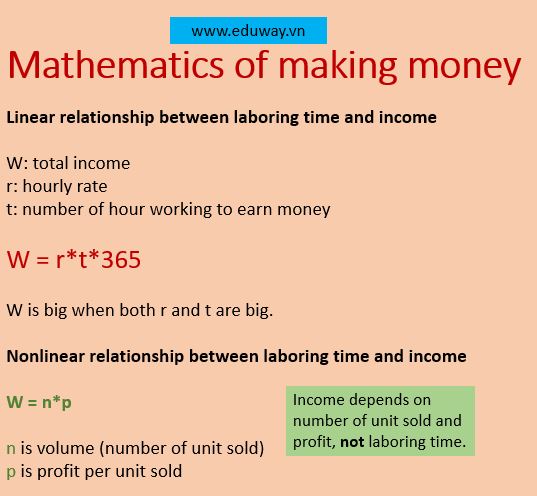

The question is how to build wealth legally? It is a mindset, a way of thinking and doing, slowly day after day. Mathematicallys, to be wealthy we must make money independently from our amount of time laboring. Or the factor must be really BIG. Let call W is amount of money we make annually, r is the amount we make per hour, and we work 10 hours a day. Then the total W = r*10*365 USD. If r is big, W is big. Suppose a business consultant charge 1000 USD per hour, he can make 3,650,000 USD per year. It is huge. Some people make even more, over 10 to 100 million USD per year.

But the problem is rarely we have chance to make 1000 USD per hour, if we have, the amount of time we make money with that hourly rate is very small. Let say r = 25 USD, then W = 25*10*365 = 91,250 USD which is quite enough for many folks.

Again, who work 10 hours per day year over year to earn money? It would be very tired. If we don’t like the work we do, life is miserable.

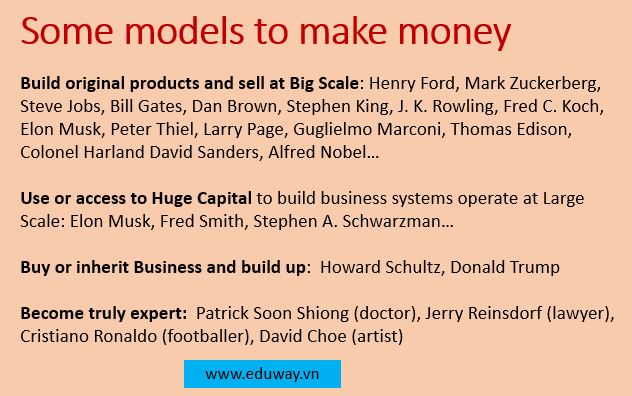

A better way to make money is using leverage: skill, capital and labor of others in business system. Business owners generally make more money than salaried people, because the owners can earn money through the system, consistently over time. Great investors are also making Big money because they can use their good judgment and capital to make money at big scale. Warren Buffet is a typical example.

Many people become wealthy after a few years working hard on producing Highly Value Products that society want at enormous scale. Elon Musk, Peter Thiel, Bill Gates, Steve Jobs, Mark Zuckerberg, Larry Page and Brin…They are very good at doing the things at the time they started and their products are extremely valuable to society at large – millions and billions of people use their products. They become wealthy for Building Good Things that the mass need.

In short, if we have enough capital, we can use capital to invest but do it smartly as Warren Buffet. Or use capital to gather talented people and tools, facilities to build good business system to serve society as Elon Musk has been doing with SpaceX and Tesla. If we have excellent skills at building some things original, we can start doing it and quickly sell to the market to capitalize on the opportunity as Bill Gates, Lary Brin or Mark Zuckerberg. The common trait of these people are they serve society at HUGE SCALE, in terms of Capital, Labor or number of end users.